When you purchase home insurance, one of the key decisions you will face is determining the type of coverage that best suits your needs. Two essential terms that come up in this context are Replacement Cost and Actual Cash Value. These terms refer to how insurance companies calculate the payout when your property is damaged or destroyed. Understanding the difference between Replacement Cost and Actual Cash Value is critical for selecting the right policy and ensuring that you are adequately protected in the event of a loss.

This article will delve into the key differences between Replacement Cost and Actual Cash Value, explain how each affects your insurance premiums, and provide guidance on how to decide which type of coverage is right for your situation.

What Is Actual Cash Value (ACV)?

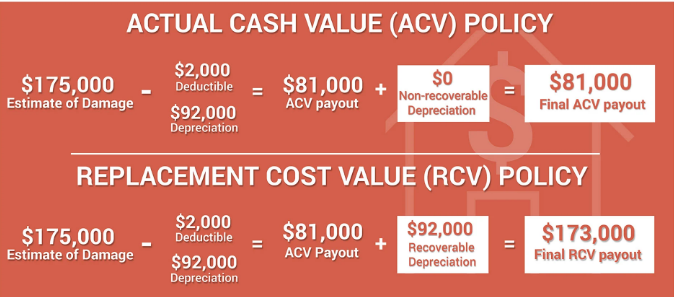

Actual Cash Value (ACV) is a method used by insurance companies to calculate the reimbursement for your property after a covered loss. ACV takes into account both the replacement cost of an item and its depreciation over time. In other words, ACV is the value of your property at the time of the loss, factoring in how much it has depreciated since it was originally purchased.

How Is Actual Cash Value Calculated?

To determine the ACV, the insurance company will assess the replacement cost of your property, then subtract depreciation. Depreciation is the reduction in value due to factors such as age, wear and tear, and obsolescence. For example, if your television was purchased five years ago for $1,000, and its estimated depreciation is 40%, the actual cash value would be $600.

Here’s how ACV works in practice:

- Determine the cost to replace the item at its current value.

- Subtract depreciation based on the item’s age and condition.

- Provide a payout for the depreciated value.

Advantages and Disadvantages of Actual Cash Value

Advantages:

- Lower Premiums: Since ACV policies generally provide a lower payout than Replacement Cost policies, the premiums for ACV coverage are often less expensive. This can make it an attractive option for homeowners on a budget.

- Affordable for Older Homes: For homeowners with older homes, ACV can be a more budget-friendly choice, as the depreciated value of their home and possessions may result in lower premiums.

Disadvantages:

- Lower Payouts: The biggest downside to Actual Cash Value is that you may not receive enough money to replace your belongings with new items. The depreciation deduction can lead to a significant reduction in the payout, which may leave you underinsured.

- Potential Insufficient Funds for Rebuilding: If your home is damaged or destroyed, the payout based on ACV may not be sufficient to fully rebuild your property with similar materials and quality. This is especially true for homes with older components that have depreciated significantly.

What Is Replacement Cost?

Replacement Cost is the amount of money it would take to replace or repair an item at today’s market value without factoring in depreciation. In simple terms, it’s the cost to replace your damaged or destroyed property with a new one of similar kind and quality.

How Is Replacement Cost Calculated?

Unlike Actual Cash Value, Replacement Cost does not consider depreciation. Instead, it focuses solely on the cost to replace an item or structure with something new. For example, if your refrigerator is damaged in a fire, and it costs $1,500 to replace it with a similar model, that is the amount you would receive under a Replacement Cost policy.

Here’s how Replacement Cost works:

- Determine the cost to replace the item with a new version.

- Provide a payout based on the full replacement cost, without deducting for depreciation.

Advantages and Disadvantages of Replacement Cost

Advantages:

- Full Replacement Coverage: The most significant advantage of Replacement Cost is that you will receive enough money to replace your damaged property with new items of similar kind and quality. This is crucial for ensuring you are not left financially strained when trying to replace your possessions or rebuild your home.

- Better Protection Against Loss: In the event of a total loss, Replacement Cost insurance ensures that you can rebuild your home or replace personal property without significant financial burden, even if the cost of construction or goods has increased since the original purchase.

Disadvantages:

- Higher Premiums: Replacement Cost coverage tends to have higher premiums compared to Actual Cash Value policies. This is because it provides a larger payout, and insurance companies must charge more to cover the cost of the policy.

- Potential Overinsurance: In some cases, a homeowner may purchase more coverage than they need, especially if the market value of their home is much higher than the cost to rebuild it. This can lead to unnecessarily high premiums.

Replacement Cost vs. Actual Cash Value in Homeowners Insurance

Now that we’ve defined both terms, it’s essential to understand how they apply specifically to homeowners insurance. The way these two coverage types apply to a home and personal property can have a significant impact on your insurance premiums and the level of protection you receive.

1. Home Structure

- Actual Cash Value: If your home is damaged or destroyed, ACV would pay out the depreciated value of the structure. This could leave you with insufficient funds to rebuild or repair your home with the same materials or to the same standard as before the loss.

- Replacement Cost: With Replacement Cost, you would receive enough to rebuild your home with new materials of similar kind and quality. This is often the preferred option for homeowners who want to ensure their property is fully restored after a loss.

2. Personal Property

- Actual Cash Value: Personal property (furniture, electronics, clothing, etc.) would be reimbursed at the depreciated value, meaning you may receive much less than what you paid for your items. This could leave you unable to replace items with new versions or similar quality.

- Replacement Cost: Personal property would be reimbursed at its full replacement cost, ensuring that you can replace damaged or stolen items with new ones of equivalent kind and quality.

Which Option Is Right for You?

Choosing between Replacement Cost and Actual Cash Value depends on several factors, including your budget, the value of your home, and how much protection you want.

Consider Replacement Cost If:

- You want full protection for your home and belongings and are willing to pay higher premiums for that peace of mind.

- Your home contains a lot of high-value items that you want to replace with new ones in the event of a loss.

- You live in an area prone to natural disasters or catastrophic events where rebuilding costs could be high.

Consider Actual Cash Value If:

- You have a limited budget and are looking to reduce your monthly insurance premiums.

- Your home and belongings are older and have already depreciated significantly in value.

- You are willing to accept a potentially lower payout in exchange for lower premiums and are comfortable with the risk of underinsurance.

Conclusion

Understanding the difference between Replacement Cost and Actual Cash Value is crucial when choosing the right homeowners insurance policy. While Replacement Cost coverage offers more comprehensive protection and ensures you can fully replace or rebuild your property, it typically comes with higher premiums. On the other hand, Actual Cash Value coverage is more affordable but provides lower payouts due to depreciation.

Ultimately, the decision depends on your personal preferences, your home’s value, and how much financial protection you need. It’s essential to review your options, assess the value of your home and possessions, and ensure that you select a policy that provides the level of coverage you need to feel secure.