When purchasing a new or even slightly used vehicle, many buyers find themselves navigating a maze of financial and insurance terms. One such term that often pops up is “gap insurance.” But what exactly is gap insurance, and who truly needs it? In this article, we’ll dive deep into the ins and outs of gap insurance, helping you determine if it’s a necessary addition to your car insurance portfolio.

Understanding Gap Insurance

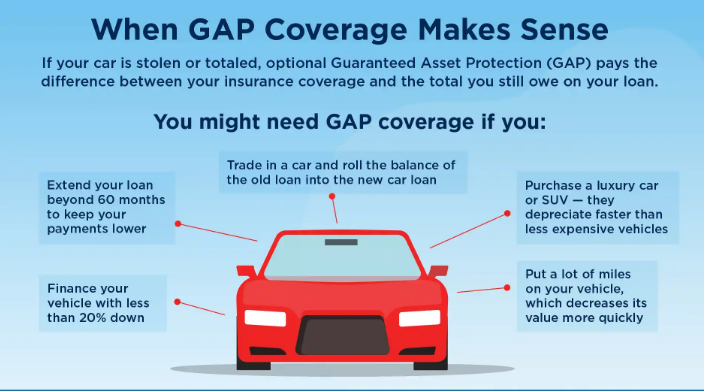

Gap insurance, short for Guaranteed Asset Protection insurance, is a type of auto insurance coverage that helps bridge the “gap” between what you owe on your car loan or lease and the car’s actual cash value (ACV) in the event of a total loss.

Here’s how it works: Let’s say you purchase a car for $30,000 and take out a loan to finance it. A year later, the car is involved in an accident and declared a total loss. Due to depreciation, the insurance company determines the car’s current value to be $22,000. However, you still owe $26,000 on your auto loan. Your standard auto insurance will pay the ACV of $22,000, but you’re still on the hook for the remaining $4,000. That’s where gap insurance comes in — it covers the $4,000 difference.

Why Cars Depreciate So Quickly

Cars typically lose 20-30% of their value within the first year of ownership and continue to depreciate in the following years. The moment a new car is driven off the lot, it becomes a used vehicle, and its resale value drops. This rapid depreciation is what creates the gap between the car’s value and the loan balance, particularly in the early stages of a loan or lease.

Who Needs Gap Insurance?

Gap insurance isn’t for everyone, but there are specific scenarios where it can be extremely beneficial. Consider purchasing gap insurance if you:

- Finance a New Car with a Small Down Payment: If you put down less than 20% on your vehicle, your loan balance may exceed the car’s value for a significant period.

- Opt for a Long-Term Loan: Longer loan terms, such as 60 or 72 months, mean slower repayment progress, which can keep you upside-down on the loan longer.

- Lease a Vehicle: Many leasing companies require gap insurance because the residual value of leased vehicles often exceeds their market value.

- Buy a Car That Depreciates Quickly: Some vehicles lose value faster than others. If you’re purchasing a car known for rapid depreciation, gap insurance might be a wise investment.

- Roll Over Negative Equity: If you carry over debt from a previous car loan into your new one, your loan balance starts higher than the car’s actual value.

Who Might Not Need Gap Insurance?

While gap insurance offers valuable protection in some cases, others may find it unnecessary. You likely don’t need gap insurance if:

- You paid for your car in full with cash.

- You made a large down payment (20% or more).

- Your loan term is short, and you’re building equity quickly.

- Your vehicle holds its value well over time.

In these situations, the likelihood of owing more than the vehicle is worth is minimal.

How to Purchase Gap Insurance

Gap insurance can be purchased in several ways:

- Through the Dealership: Dealerships often offer gap insurance at the time of vehicle purchase. However, this is usually the most expensive option.

- From Your Auto Insurance Provider: Many car insurance companies offer gap insurance as an add-on to your existing policy. This is typically the most affordable and convenient route.

- Through a Bank or Credit Union: Some lenders offer gap coverage when you finance your vehicle. The cost may be included in your loan.

When considering gap insurance, it’s essential to compare quotes and understand the terms. Some policies only cover specific scenarios or have limits on the payout amount.

Cost of Gap Insurance

The cost of gap insurance varies based on the provider and your specific circumstances, such as the type of vehicle and loan amount. On average:

- Dealerships may charge a one-time fee of $400 to $700.

- Auto insurers may charge $20 to $40 per year if added to your comprehensive and collision policy.

Although dealership options may seem convenient, they tend to be more expensive in the long run. Shopping around and comparing quotes can save you money.

When to Cancel Gap Insurance

Gap insurance isn’t meant to last forever. Once your loan balance drops below the vehicle’s actual value, the coverage becomes unnecessary. Monitor your loan balance and car value regularly and cancel the coverage when you no longer owe more than the car is worth.

Conclusion

Gap insurance is a valuable financial tool for certain car buyers, especially those with minimal down payments, long loan terms, or leases. It provides peace of mind by covering the difference between a car’s value and the amount owed on it if the vehicle is totaled or stolen.

However, it’s not a one-size-fits-all product. Evaluating your financial situation, loan terms, and the car’s depreciation rate can help you decide whether gap insurance is right for you. If the numbers suggest that you might be upside-down on your car loan at any point, gap insurance can be a wise and cost-effective safety net.

Always remember to shop around, understand the policy terms, and reassess your needs periodically to ensure you’re not paying for coverage you no longer require.