Health insurance is one of the most important tools for protecting yourself and your family against high medical costs. But for many Americans, understanding how health insurance pricing works—and how to save money—can be confusing. Between premiums, deductibles, co-pays, and out-of-pocket maximums, the costs can add up quickly.

This article breaks down the main components of health insurance costs, explains what factors affect your premiums, and offers practical strategies to save money without sacrificing the care you need.

Understanding the Basics of Health Insurance Costs

Health insurance isn’t just a monthly payment. There are multiple cost components to consider when choosing and using a plan:

1. Premium

This is the amount you pay each month for your health insurance plan, whether you use health care services or not.

2. Deductible

The amount you must pay out-of-pocket before your insurance starts covering services. For example, with a $2,000 deductible, you pay the first $2,000 of covered services yourself.

3. Co-payment (Co-pay)

A fixed fee you pay for specific services, like $30 for a doctor’s visit or $10 for a generic prescription.

4. Coinsurance

After meeting your deductible, you typically pay a percentage of costs (e.g., 20%) while your insurer covers the rest.

5. Out-of-Pocket Maximum

The most you’ll pay in a year for covered services. Once you hit this limit, your insurance covers 100% of eligible costs.

Average Health Insurance Costs in the U.S.

According to 2024 data:

- The average monthly premium for an individual on a marketplace plan (without subsidies) is around $560.

- Family coverage averages over $1,500/month.

- Deductibles for employer-based plans average about $1,700 for individuals and $3,700 for families.

However, actual costs vary widely based on:

- Location

- Age

- Tobacco use

- Plan type (e.g., Bronze vs. Gold)

- Household income

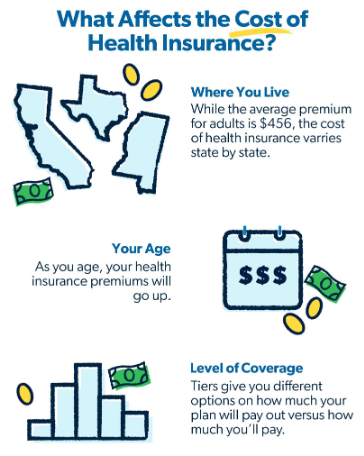

Factors That Influence Health Insurance Costs

Understanding what drives your premium and out-of-pocket costs can help you make better choices.

1. Plan Tier (Bronze, Silver, Gold, Platinum)

- Bronze: Lowest premiums, highest deductibles (good for young, healthy individuals)

- Silver: Moderate costs; only tier eligible for cost-sharing reductions

- Gold/Platinum: Higher premiums, lower out-of-pocket costs (good for frequent care needs)

2. Age

Older individuals pay higher premiums due to higher risk. Insurers can charge up to 3 times more for older enrollees.

3. Location

Health care costs vary by region, which impacts premiums and network size.

4. Tobacco Use

Insurers may charge smokers up to 50% more in premiums in many states.

5. Household Size and Income

Lower-income families may qualify for subsidies or Medicaid, significantly reducing costs.

Government Subsidies and Programs That Lower Costs

The Affordable Care Act (ACA) made health insurance more accessible through financial assistance:

1. Premium Tax Credits

These are subsidies that reduce your monthly premium cost if your income is between 100% and 400% of the federal poverty level (FPL). As of 2024, temporary expansions also help people above 400% FPL.

2. Cost-Sharing Reductions (CSRs)

Available if you choose a Silver plan and your income is between 100% and 250% of FPL. These reduce:

- Deductibles

- Co-pays

- Out-of-pocket maximums

3. Medicaid and CHIP

Low-income individuals and families may qualify for Medicaid, which offers low- or no-cost coverage. Children may be eligible for CHIP even if parents don’t qualify for Medicaid.

4. Marketplace Enrollment Periods

Open Enrollment typically runs from November 1 to January 15, but Special Enrollment Periods (SEPs) are available after qualifying life events (e.g., losing coverage, getting married, having a baby).

Ways to Save on Health Insurance and Medical Costs

Even with a good plan, out-of-pocket costs can be high. Here are practical tips to reduce your health care spending:

1. Choose the Right Plan for Your Needs

If you’re healthy and rarely visit the doctor:

- A Bronze plan with low premiums and high deductibles may save you money.

If you have ongoing health issues or take expensive medications:

- A Gold or Silver plan may be more cost-effective in the long run, due to lower out-of-pocket expenses.

2. Use In-Network Providers

Sticking to providers within your insurance network helps you avoid surprise bills and higher fees. Before scheduling appointments, always verify that the provider and facility are in-network.

3. Compare Plans and Shop Around

Don’t just auto-renew your existing plan. Every year, premiums and coverage options change. Use Healthcare.gov or your state marketplace to compare available plans side-by-side.

4. Use Preventive Services

Most ACA-compliant plans cover preventive services at no cost, including:

- Annual physicals

- Vaccines

- Cancer screenings

- Birth control

- Mental health screenings

Taking advantage of these services helps you catch issues early and avoid costly treatment later.

5. Open a Health Savings Account (HSA)

If you have a High Deductible Health Plan (HDHP), you can open an HSA to:

- Save pre-tax dollars

- Pay for eligible medical expenses (including deductibles, prescriptions, vision, and dental)

- Carry funds forward year to year

Bonus: HSA contributions reduce your taxable income.

6. Use Telehealth Services

Many plans now include telemedicine visits, which are cheaper than in-person visits and just as effective for many common issues like cold symptoms, therapy sessions, or medication refills.

7. Look Into Prescription Savings

- Use generic drugs when possible.

- Ask your doctor for lower-cost alternatives.

- Check manufacturer coupons, GoodRx, or NeedyMeds to reduce pharmacy costs.

8. Negotiate and Ask for Payment Plans

If you’re facing a large medical bill:

- Ask the provider’s billing office about discounts for cash payments.

- Request a payment plan with no interest.

- Some hospitals offer financial assistance or charity care programs.

Managing Health Insurance Year-Round

Keep Track of Your Spending

Use your insurer’s app or website to monitor your deductible and out-of-pocket max progress.

Reevaluate Annually

During open enrollment, recheck your plan and see if another option better suits your current health needs.

Report Income Changes

If you’re receiving subsidies, report changes in income to avoid tax penalties or ensure you get the right amount of help.

Final Thoughts

Health insurance can be complex, but understanding how it works is key to making smart, cost-effective choices. By learning the ins and outs of premiums, deductibles, and subsidies—and by being proactive in how you use your plan—you can save money and ensure you’re getting the care you need.

Don’t wait until you’re sick to think about your insurance. With a little planning and attention, you can protect both your health and your wallet.